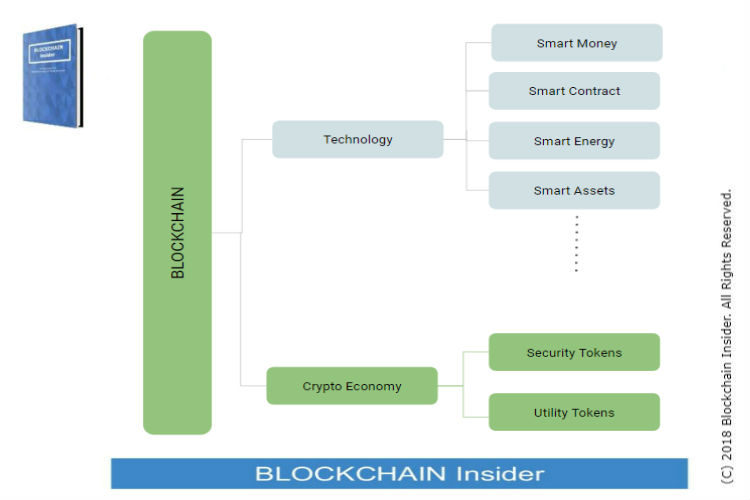

What can we do with Blockchain? To answer this question, we can look at Blockchain from two perspectives, the technology part, and the crypto economy part of it.

Blockchain – The Technology

If you are old enough in the tech industry, you will notice that the Blockchain is a revolution that builds on another technical revolution so old that only the more experienced among us remember it: the invention of the database. As such, the technology part of it concerns more on how we can apply the technological breakthrough to organizations, corporates, and governmental bodies.

In fact, IBM, which has engaged in more than 400 blockchain projects across a number of industries, including supply chain, financial services, healthcare and government, sees Blockchain as much more than the foundation for cryptocurrencies like Bitcoin and wants the government to consider embracing it as a way of saving time, cost and risk.

In summary, it is more about how we can leverage the design and the immutability of this technology to make our computer systems more efficient and more secure.

Crypto Economy – Opportunities and Risks

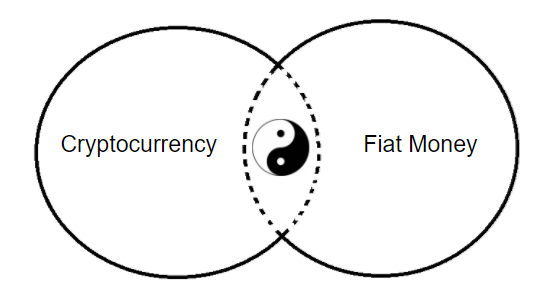

What we have now is truly borderless, programmable money backed by immutable computer systems based on pure logic & mathematics.

The crypto economy part of it deals not only on how we can further put back more financial power into the hands of an ecosystem’s stakeholders but on a much bigger picture in terms of traditional players defending their forte and revolutionists creating a more open, fairer financial systems for the people.

It’s the evolution of money towards a moneyless society and the possible disruption of the whole financial system as we know it today.

It can be done through Blockchain consensus and programming logic. It’s a matter to trust human beings or computer systems or to strike a balance between both side of the world.

“We are in the early phase of Blockchain now. We can define its impact on mankind.” ~ Roberto Capodieci, Playing with Blockchain Consensus workshop, 22-23rd Feb 2018

May the force be with you.

Notes: Excerpt from Chapter 3 – Smart Money of the book Blockchain Insider.

Related News At Time of Writing

According to a recent European Commission Roundtable related to cryptocurrencies, while the so-called cryptocurrencies and their underlying blockchain technology is affecting many sectors of the economy (including finance), it is now more than important for financial institutions, governmental organizations and corporates to learn how they should respond to the challenges posed by fast technological developments, and seize the opportunities the technology could offer.

The goal of any government or financial authorities is to ensure investor protection, market integrity, and financial stability while taking full advantage of these new technological developments:

1) Cryptocurrencies and their implications for financial markets

2) Investor protection and market integrity in relation to cryptocurrencies as an emerging asset class, and

3) The potential and challenges posed by initial coin offerings (ICOs)

Source: European Commission Roundtable: Blockchain ‘Holds Promise,’ Investors Must Know Risks