Sheriffs in town. So are wolves of wall streets. To the moon. Or better, “to Mars,” in Elon Musk style?

Read MoreUnderstanding Bitcoin or Simply Buy Sell?

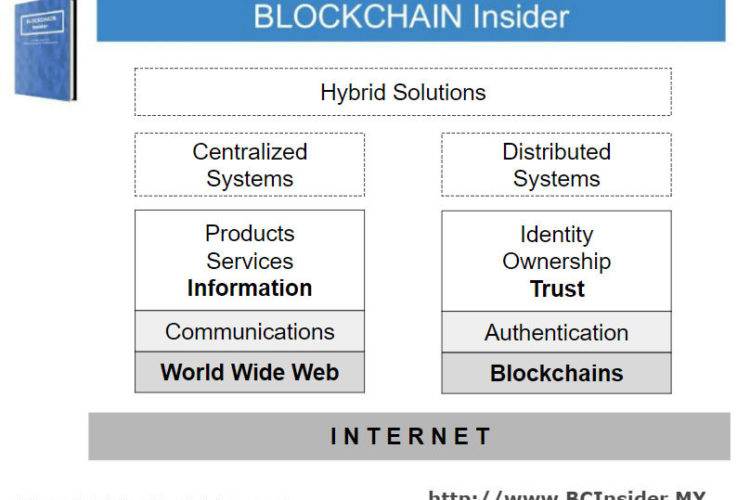

Déjà vu. The say blockchain is the internet, all over again. Some truth in it.

Read MoreBitcoin’s 12th Anniversary, A Brief Chronology

And the rest, as they said, is history … Reading notes from article by OSATO AVAN-NOMAYO: https://cointelegraph.com/news/bitcoin-turning-12-from-the-genesis-block-to-wall-street-adoption BTC 12th Anniversary: From the Genesis block to Wall Street adoption Jan. 3, 2009 Satoshi mined the Genesis block, known as #0, coding it into the software. Jan. …

Read MoreBitcoin, Digital Gold 2.0?

Amount of gold is not finite as people tend to believe. Bitcoin is transparently finite, pure mathematics and logic verifiable via public ledger.

Read MoreBitcoin vs Gold

INX is set to acquire OpenFinance’s broker-dealer and alternative trading system business including its systems, digital asset listings, client base and licenses.

Read MoreMicrostrategy’s BTC Bet

“There are 3500 publicly traded companies and there’s $5T in their treasuries and it’s all melting. At some point, you have a fiduciary obligation to not lose the money. It used to be acceptable to be conservative but that was before the asset inflation rate went from 6% to 30%” ~ Micheal Saylor

Read MoreROTD: Microstrategy Bitcoin Investment, Facebook Finance, Chinese Paper Money

MicroStrategy Adopts Bitcoin as Primary Treasury Reserve Asset

Read MoreA Cryptocurrency As The New Reserve Currency?

The Chinese government is working on something called DC/EP (for “digital currency/electronic payment”), as we check out the financial inclusion in the fintech era.

Read MoreSmart Money

Finally, get the whole chapter uploaded after a year plus of work and went through a major chapter revamp. It not getting this done, it will become a history book. Pardon my English, I grow up in a Commonwealth country under legacy of British education …

Read MoreBlockchaining Sukuk

Blockchaining Sukuk – Crypto Is The Future It’s not a matter of “IF” Crypto will take on the financial world, but rather just a question of “WHEN”. You can either get left behind or prepare to become mega wealthy, because getting in on the boom …

Read MoreBitcoin Weekly Meetup KL

First sharing on 3C’s of Crypto Ecosystem to the public at Bitcoin Weekly Meetup KL. Met quite a few new friends. Nice people, great ambient. Some paid their bills with cryptocurrency. First speaker was Ng Chung Yee, sharing on SteemIt. With a little bit of …

Read MoreWe Have Just Uploaded Our Online Chapter to Slideshare!

To explore Blockchain,

you need to study Bitcoin.

To understand Bitcoin,

you need to know what is money and how it works.

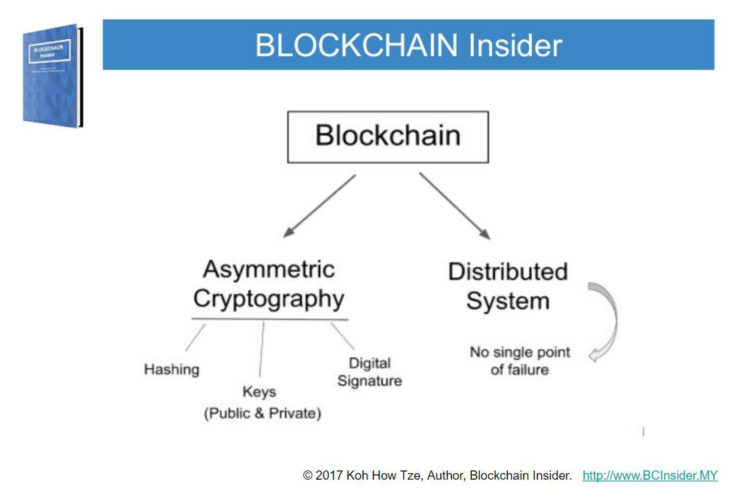

Blockchain Security

How secure is Bitcoin? How strong is the security of Blockchain? How immutable can it be? The interesting thing about Bitcoin is since its inception, no one’s cracked it. Yet it’s completely in the open. Blockchain, or Bitcoin, to be specific, survived not because it …

Read MoreMalaysian Now Use Bitcoin To Buy Durian!

While Bitcoin continues its quest to make record high, and brouhaha still going on around the world regarding the legality and application of this cryptocurrency, more and more Malaysians are now using Bitcoin as a form of payment in their daily life, from paying workshop service fees of their automobile maintenance to even buying the King of fruits – Durian (The King of Fruits in Malaysia)!

Read MoreBlockchain or Bitcoin: Understanding the differences

What is bitcoin? What is the Blockchain? If you happen to have a platform that guarantees certain trust functions, one very useful application for that is to build a currency, and a payment network. But you can build more things.

Read MoreThe Bitcoin Big Bang: How Alternative Currencies Are About to Change the World

Ultimately, The Bitcoin Big Bang answers one of the most pressing questions in finance, business, government, and beyond: “What is Bitcoin and how will it change the world?” It is a story of evolution.

Read More3 Must Watch Videos To Better Understand Blockchain

In order to understand Blockchain, we should to take a look into Bitcoin, which is one of the most successful Blockchain application at the time of writing. There is more to this crypto currency. We had gone through quite some video info and we think the 3 videos that we are going to share in this post are among the best for anyone to get a full picture on cryptocurrency, bitcoin, the blockchain, and the possible future where these technologies can bring us into.

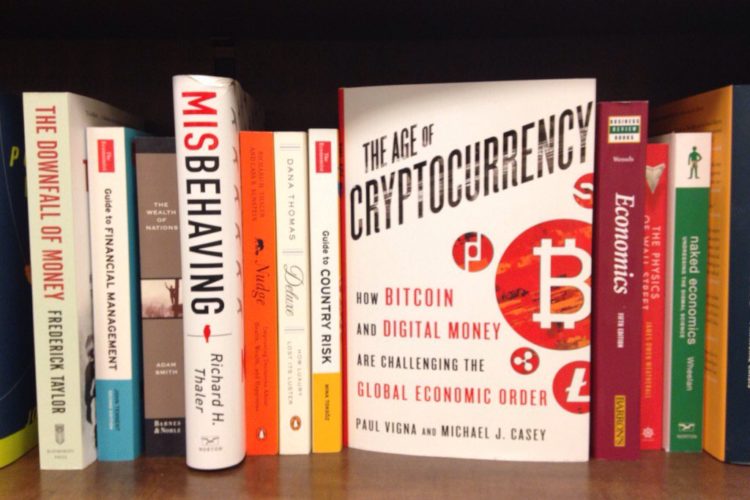

Read MoreThe Age of Cryptocurrency

Why should I give a damn about bitcoin? The day you started earning and spending money is the day you began repeatedly handling over slices of that money to these middlemen, often adding up to millions of dollars over a single person’s lifetime. Crytocurrency promises to stop that outflow and put the money back in your pocket.

Read MoreBlockchain, Bitcoin, Money

To explore Blockchain, you need to study bitcoin. To understand bitcoin, you need to know what is money and how it works.

Read More