Had a chance to share with Universiti Tunku Abdul Rahman (UTAR) Kampar Campus Blockchain Club’s students on the topic of Blockchain, Bitcoin, Money on 4th Sept, 2022 (Sunday) over Zoom.

The title was “The Evolution of Money”, where one of previous sharing back in 2018 on Blockchain, Bitcoin, Money fit perfectly for the content to be shared.

After 4 years, it has become clearer on the progress and future of the money we are augmenting, through the blockchain and emerging tech space.

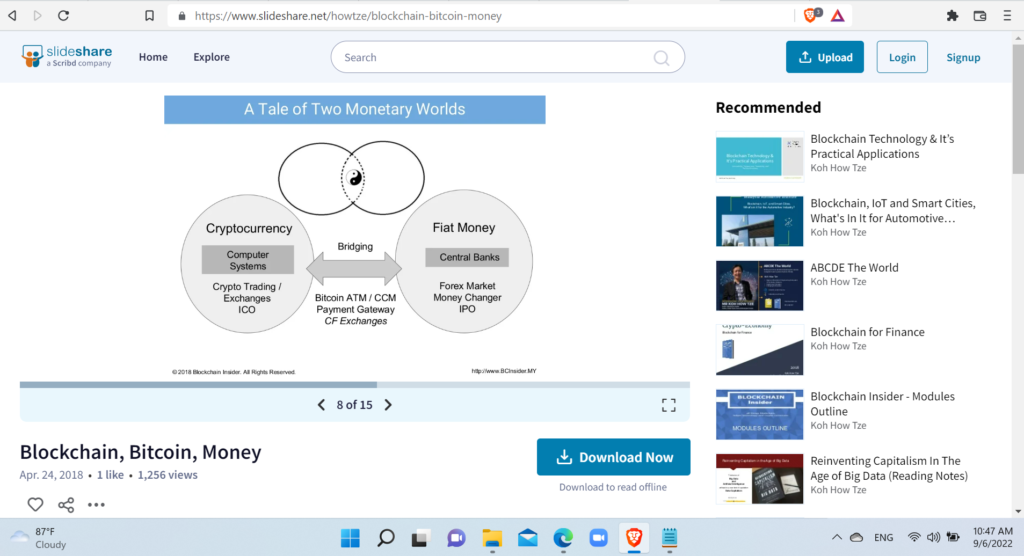

The interesting part would be how we are going to formulate and eventually actualize the future monetary system taking the best from both the legacy financial system and the crypto realm.

Blockchain, Bitcoin, Money

The Future of Money (Webinar Recording)

Gold Standard 2.0

Are we going back to Gold Standard or a better one getting the best from both existing systema and the native digital asset?

This is an interesting open discussion but we are progressing anyhow in achieving shared prosperity.

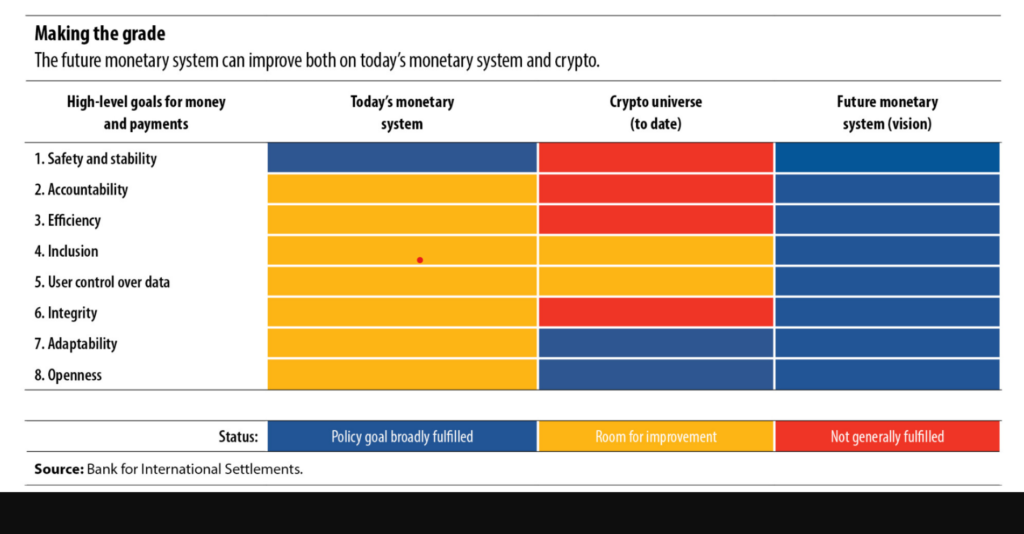

Crypto’s adaptability, openness key to ideal monetary system, say BIS execs

Happened to come across this article by CoinTelegraph titled “Crypto’s adaptability, openness key to ideal monetary system, say BIS execs” which shows the diagram from Bank for International Settlements’ suggested future monetary system, that can be improved both on today’s monetary system and crypto.

Coincide with that Two Monetary Worlds diagram above but the one from BIS in tabular form and more detailed.

Notes

Russian gov’t working on stablecoin settlement platform between friendly nations: State media

Russia’s Finance Ministry has reportedly begun working with the governments of “friendly” nations to establish a cross-border stablecoin-based payments platform.

“We offer mutually acceptable tokenized instruments that will be used on these platforms, which are essentially clearing platforms that we are currently developing with countries,” said Moiseev. “Stablecoins can be pegged to some generally recognized instrument, for example, gold, the value of which is clear and appreciable for all parties involved.”

Follow The Yellow BRIC Road (To A New Digital Reserve Currency?)

The history and future of money: Before Babylon, Beyond Bitcoin

It does make you wonder, though, whether the world does need a new reserve currency.

Do we need a new digital gold standard?

And if so, should it be fiat or commodity-based?

And if it’s to be commodity-based, then what commodity?

Should there be a digital gold standard?

In June, President Putin (presumably stimulated by the international community’s response to Russia’s invasion of Ukraine) said that Brazil, Russia, India, China, and South Africa (the BRICS) are developing a new basket-based reserve currency.

The presumption is that it will comprise real, roubles, rupees, renminbi and rand to present an alternative to the IMF’s Special Drawing Right (SDR).

Much as Facebook’s doomed Libra project wanted to, the goal is to create a stable reserve currency that can be used for international commerce.

In this case, the Brics Bucks (as I call them) reserve will be independent of the dollar completely.