Crossing the year moving from 2019 to 2020, we expect a few progress happening this year in the banking industry.

Banking in 2020

(1) From Paper Money to Digital Currency

As blockchain technology is able to bring down borders of financial products as defined in the conventional way of doing things, it is a matter of:

How do we define money in the new paradigm?

(2) Data Is The New Oil

One of the capabilities of Blockchain and its practical applications would be to turn data into currency, something coined as datanomics – data + economics.

(3) The Dawn of Crypto Bank

Looking at the three phases of cryptocurrencies, we are now slowly moving into the stage of corporate currency implementation. CBDC is happening anyhow.

So, where is the big deal?

Blockchaining Sukuk

Blockchaining Sukuk, crypto is the future.

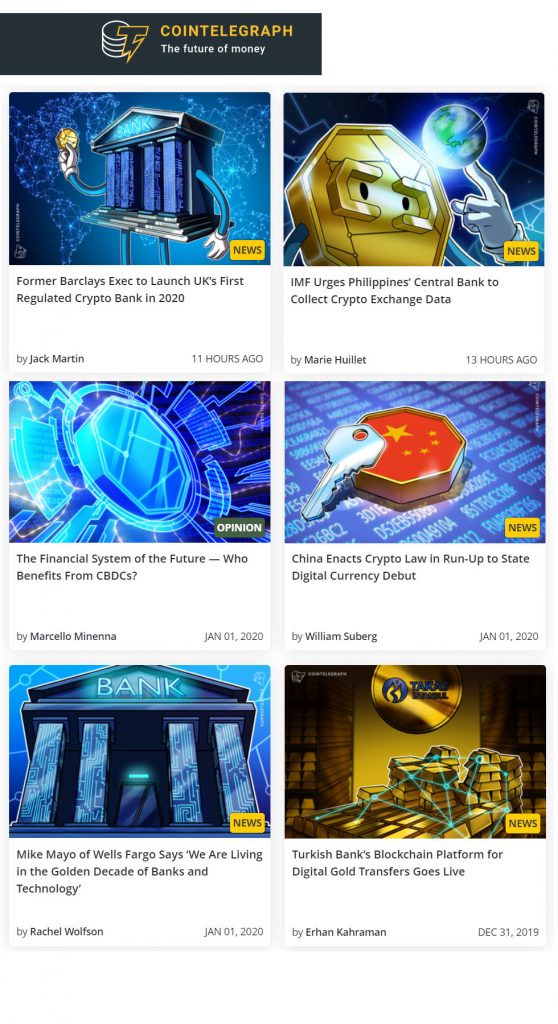

News from CoinTelegraph

As reported by Cointelegraph, information related to blockchain, cryptocurrency, and the banking industry within the past 48 hours at the time of writing:

Former Barclays Exec to Launch UK’s First Regulated Crypto Bank in 2020

Billing itself as the next step in the challenger bank concept, the all-digital account will allow multiple currencies, both fiat and digital, to be held in the same account- HODL, exchange, spend.

IMF Urges Philippines’ Central Bank to Collect Crypto Exchange Data

According to a Technical Assistance Report paper released Dec. 30, 2019, the IMF’s Philippines mission encouraged the central bank to start exploring the possibility of collecting data on these crypto exchanges for its macroeconomic analysis, particularly in regard to international financial flows using crypto assets.

The Financial System of the Future — Who Benefits From CBDCs?

A CBDC is a new type of legal tender which will expand the public’s digital access to central bank accounts, which is limited to commercial banks today. As a result, this tool will combine the digital nature of bank deposits with the classic advantages of cash in daily transactions. A key point to carefully consider, though, is,

To what extent is this the case?

Would the new currency take the form of a personal account at the central bank that can pay positive interest rates, or that of an anonymous digital token without interest, like classic cryptocurrencies?

China Enacts Crypto Law in Run-Up to State Digital Currency Debut

The central bank’s tests are ongoing – while China has not yet set a formal release date for its CBDC, which will be the first state-backed cryptocurrency on the world stage, the Standing Committee of the 13th National People’s Congress in China passed the crypto law on Oct. 26, 2019.

It divides passwords at large into three distinct categories — passwords, common passwords, and commercial passwords — and aims to facilitate China’s transition to blockchain technology.

Mike Mayo of Wells Fargo Says ‘We Are Living in the Golden Decade of Banks and Technology’

Mayo predicts that the financial sector is ripe for big advances over the next 10 years. That decade of thriving banks will be technology-enabled.

Turkish Bank’s Blockchain Platform for Digital Gold Transfers Goes Live

Following the announcement of plans for a national blockchain infrastructure, Turkey has seen steady growth in blockchain projects, both in the public and private sectors.

Turkey’s Istanbul Clearing, Settlement and Custody Bank (Takasbank) announced that its blockchain-based, physical gold-backed transfer system enables participating banks to transfer digital assets representing a quantity of physical gold.

This platform distinguishes itself from many similar projects in the world by allowing the use of blockchain technology to transfer digital assets based on physical commodities, not having any value of its own, and ensuring full compliance with existing regulations.