Updated: 8th April, 2018

A lot of progress happened in the Crypto world during the first quarter of 2018. As the authorities step in, two prominent figures from the financial world gave their views on the Crypto World in March 2018, coincidentally.

2 Mar, 2018 – “The Future of Money” by Mark Carney, Governor of the Bank of England

15 March 2018 – “Crypto Tokens: The Good, The Bad, and The Ugly” by Ravi Menon, Managing Director, Monetary Authority of Singapore

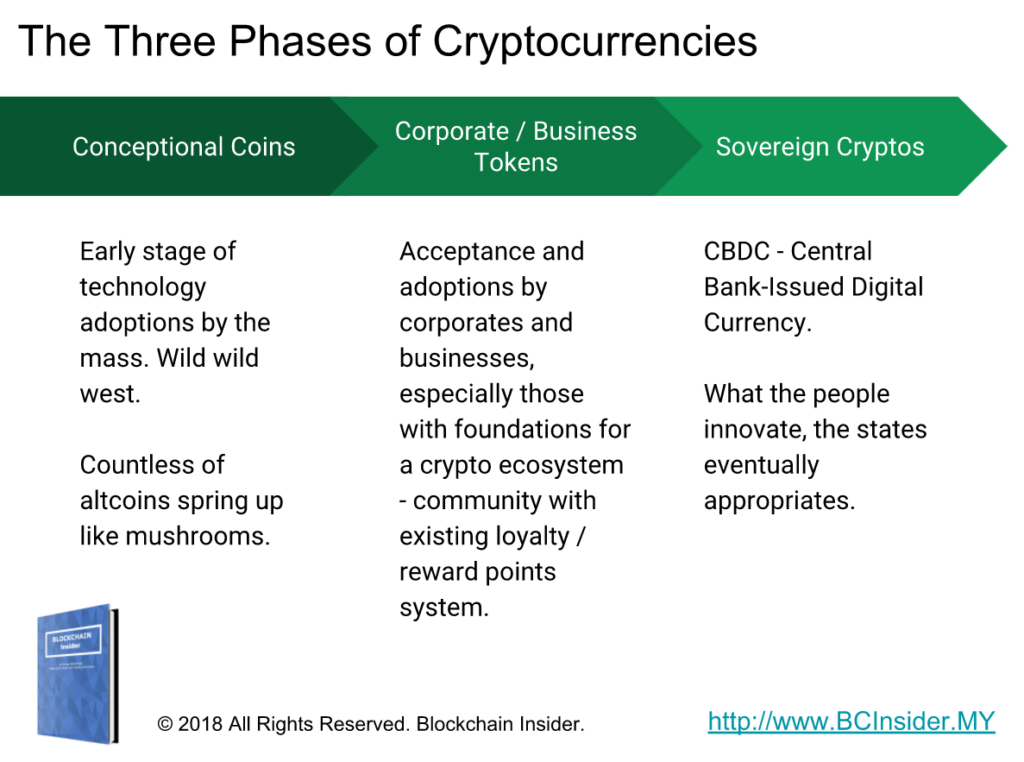

On the corporate and business side, Starbucks Corp. Chairman Howard Schultz believes that a trusted consumer brand with brick-and-mortar locations will help bring “legitimacy and trust” to cryptocurrencies. Which, is true, looking at how the market progress after his view was published in Bloomberg Technology in Jan 2018.

Earlier Mar 2018, the Messaging app company Telegram closed an initial $850 million in funding as part of an ICO that could bring in as much as $2 billion in total.

16 Mar 2018, Tony Fernandes, CEO of AirAsia (the $3 billion low-cost airline company in Southeast Asia) which is publicly listed in Malaysia, told TechCrunch that he is analyzing the potential to hold an ICO that would raise money by introducing its own cryptocurrency on the sidelines of Money2020 in Singapore.

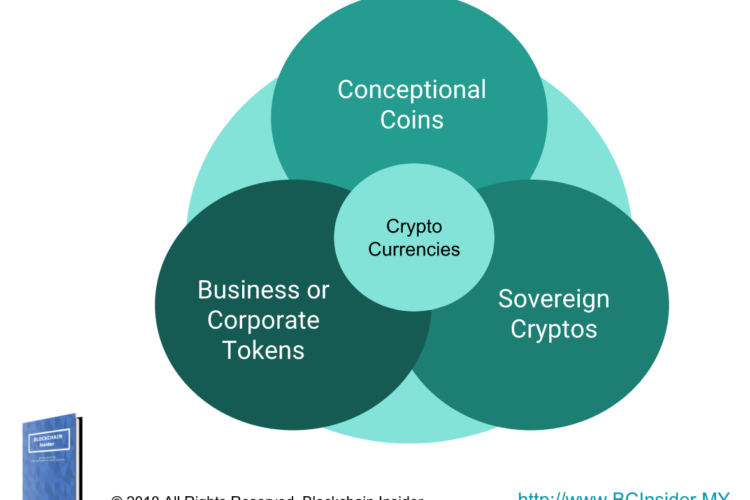

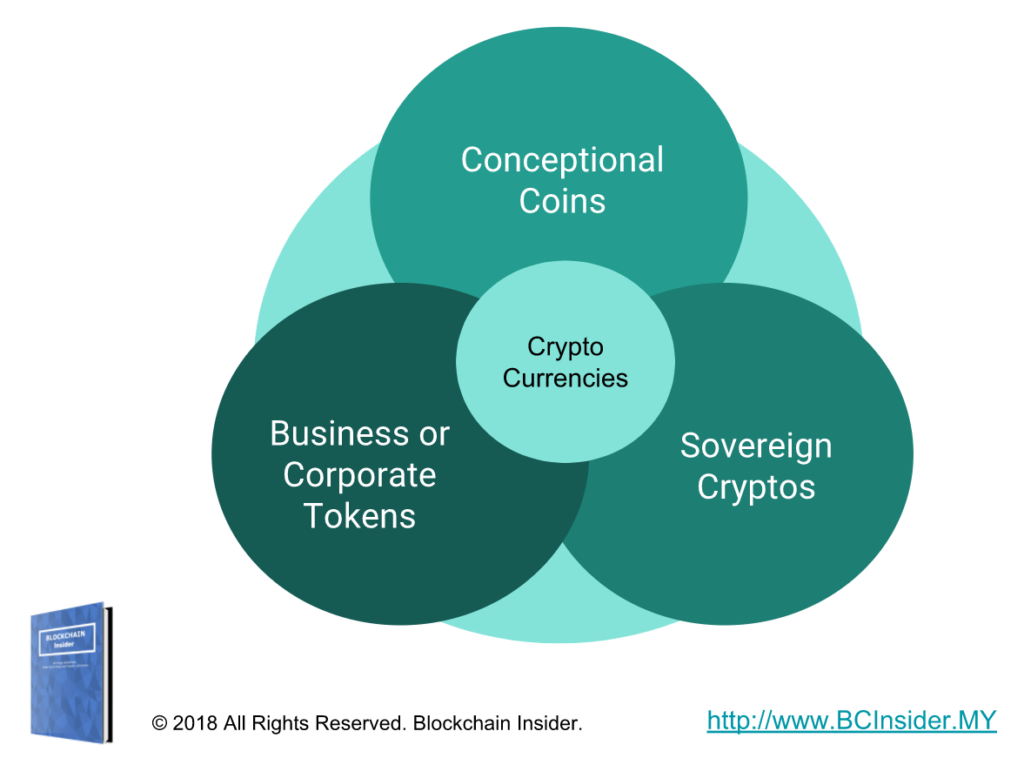

What we see here is how the digital currency is evolving and how it might eventually be dominance by the authorities.

90% of today’s altcoins will vanish, replaced by trusted consumer brands’ token and eventually, sovereign cryptos backed by the governments or authorities. ~ How Tze, Blockchain Insider

Updated: 28th December, 2018

2 Articles in December 2018, one from Time magazine, one from WSJ

(1) Why Bitcoin Matters for Freedom

Innovation happens at the edge. For people living under authoritarian governments, Bitcoin can be a valuable financial tool as a censorship-resistant medium of exchange.

http://time.com/5486673/bitcoin-venezuela-authoritarian/

(2) Once a Rebel, Bitcoin Is Conforming to Mainstream Markets

The influx of money from traditional investors has led the cryptocurrency to behave more like a traditional asset

https://www.wsj.com/articles/once-a-rebel-bitcoin-is-conforming-to-mainstream-markets-11546005600

We shall see how the distribution may look like in next article.

Excerpt from the book Blockchain Insider, Chapter 3: Smart Money

Related News:

Inside Telegram’s ambitious $1.2B ICO to create the next Ethereum

AirAsia, Southeast Asia’s low-cost airline, is considering an ICO

CBDC – Central Bank-Issued Digital Currency

As reported by Coin Telegraph in an article about Reserve Bank of India considering Central Bank-Issued Digital Currency

As early as 2016, the Bank of England and the People’s Bank of China explored the idea of issuing their own digital currencies, with over 90 central banks worldwide that same year investigating DLT tech.

In 2017, the Bank of Canada published extensive research into the benefits of CBDCs, and already in the first months of 2018, banks in Malaysia, Taiwan, Poland, Switzerland, among others, have all made news with inquiries into the use of Blockchain systems.

Earlier April 2018, an R3 researcher stirred a Deconomy panel in South Korea with his prediction that wholesale CBDCs would see real-world implementation in 2018.