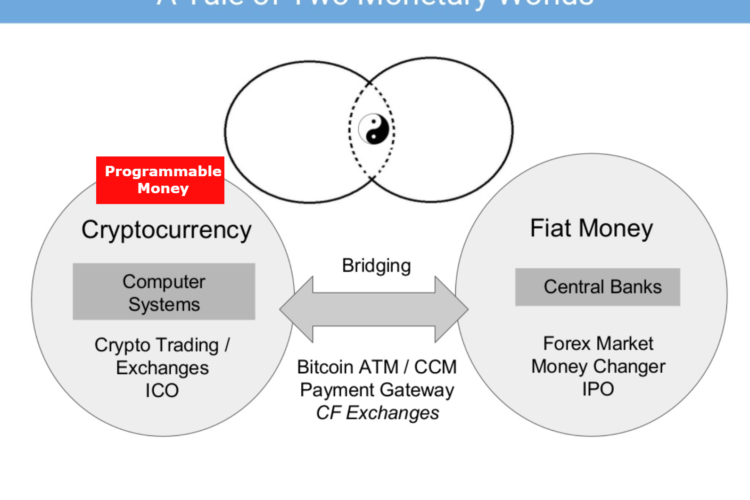

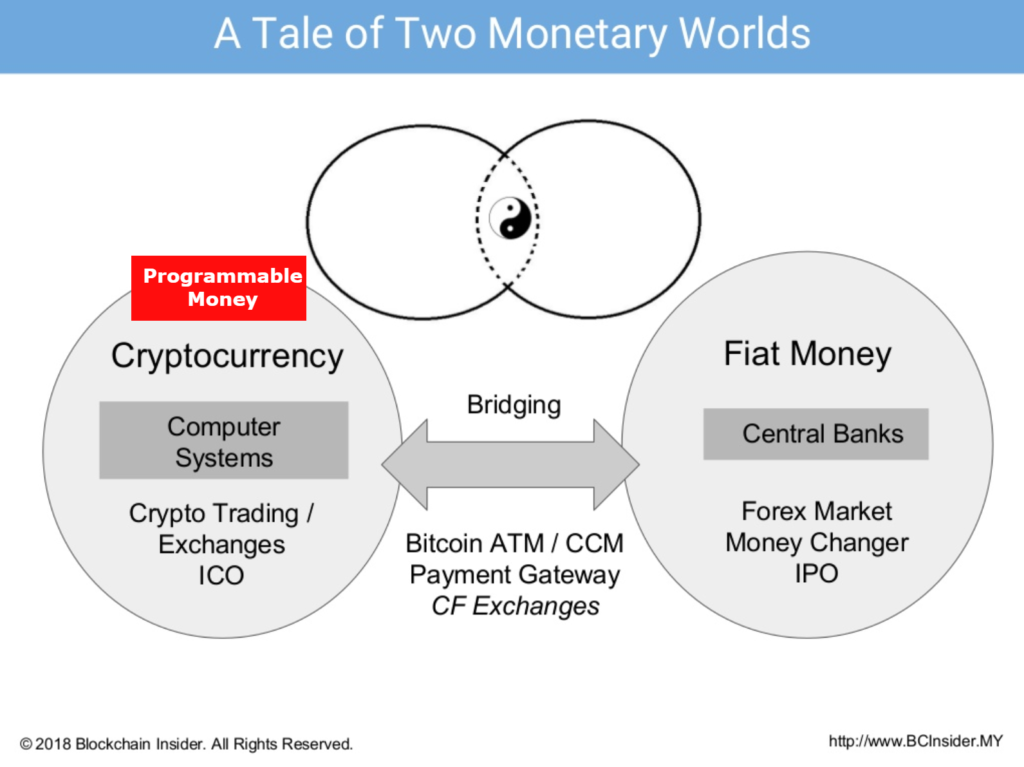

Programmable Money

The key is programmable money.

What we have now is truly border-less, programmable money backed by immutable computer systems based on pure logic & mathematics.

Effective resource allocation and distribution can be achieved through cognitive AI system and business process automation.

Two Monetary World and The Exchanges

There are 2 types of exchanges related to the crypto world at the time of writing:

- Fiat Exchanges (USD), and

- Crypto-to-Crypto Exchanges

Fiat Exchanges convert your fiat currency to crypto, that means depositing USD (or your country’s currency) with an exchange in order to get BTC (Bitcoin) or ETH (Ether). Some of the famous exchanges under this category are Coinbase, CoinMama, Kraken,

CEX.io, LocalBitcoins, BitStamp, Gemini, BitFlyer etc.

Crypto-to-Crypto Exchanges are those exchanges with more options, they carry more niche currencies. Some examples are Binance, Bittrex, Cryptopia, KuCoin, Poloniex etc.

As a matter of cautious, if you’re new to crypto investing, be sure to read up on best practices for keeping your crypto secure like using two-factor authentication and moving your coins to a private wallet once you’ve purchased them.

You can get further information about the exchanges from Coin Central’s article Top Cryptocurrency Exchanges in 2018.

At the time of writing, we have yet to see any conventional or mainstream exchanges moving into the crypto space, though there had been news and rumors about Nasdaq or Switzerland’s largest stock exchange wants to offer cryptocurrencies.

Nation-State Backed Crypto Exchanges?

Do we need a nation-state level crypto exchange? Does it make sense to have one? Why would we need that in the first place?

Before we figure out what are the purposes of having a nation-state level crypto exchange, we should take a look at what can a nation-state crypto exchange do. Two of the main functions of a nation-state crypto exchange are nonetheless:

1) Create and mobilize capital in crypto form, and

2) Moving capital in between crypto and fiat systems, where the bottom line is stability

Combine the monetary part of the Blockchain (the cryptocurrency) and the technology part of it, it’s not hard to figure out that the benefits of having a nation-state level crypto exchange would be:

1) To provide real-time, transparent view of capital flows

2) An immutable ledger of capital trail for the authorities

3) Jobs creation and ripple effects to the country through the implementation of crypto economy, and

4) Effective and automated tax collection through programmable money (the cryptocurrencies)

Programmable money is the future

But, where is the money?

For instance, the creation of another entity that could be as big, or even bigger than conventional stock exchanges in some countries, such as the Bursa (counter 1818) of Malaysia, which take cares of matters related to global scale crypto and tokenized businesses listed on board.

The challenge is, how do we distribute ‘the cake’?

Excerpt from Chapter 3 of the book Blockchain Insider, Smart Money.

Notes:

At the time of writing, around 16th of August 2018, Binance LCX just launched its Fiat-to-Crypto Exchange in Liechtenstein, and Thai SEC just cleared seven cryptocurrency operators to serve clients while reviewing two more – as reported by CoinTelegraph.

News links:

https://www.businesswire.com/news/home/20180816005660/en/Binance-LCX-Announces-Fiat-to-Crypto-Exchange-Crypto-Investors

https://www.sec.or.th/th/Pages/News/Detail_News.aspx?tg=NEWS&lg=th&news_no=89&news_yy=2561