It is like sitting at the front row watching history unfolding itself.

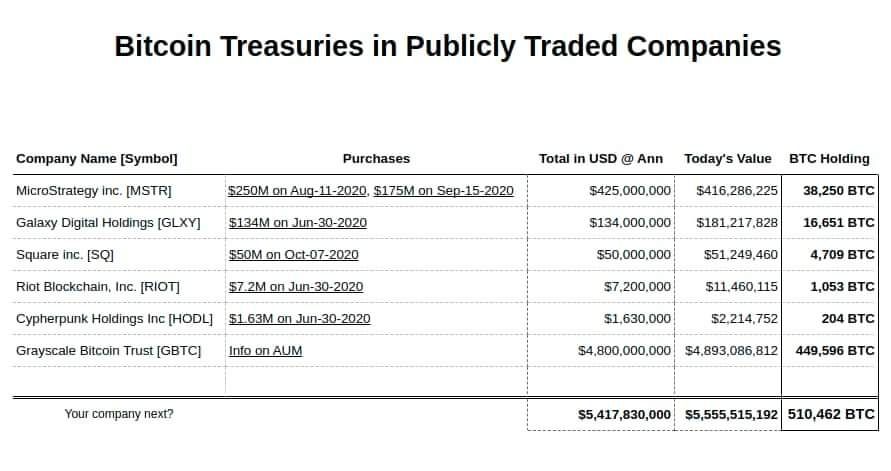

The time has come as institutional investors are coming to town building bitcoin treasuries in public listed companies.

On the other hand, competition is heating up in the CBDC space.

Chinese government presumably aims to have the first-mover advantage by being the first global jurisdiction to adopt a CBDC.

China Finance, a magazine run by the People’s Bank of China (PBOC), published an article stating that the rights to issue and control a digital currency would become a “new battlefield” of competition between sovereign countries.

Meanwhile in Japan…

- Senior Japanese official fears China being ‘first-mover’ in digital currency

- Bank of Japan to begin digital currency proof-of-concept in 2021

- Financial giant SBI to run its first security token offering in October

Digital Currency / CBDC In Case of Forces Majeure

The BoJ report notes that a core feature of the digital currency must be resilience in the face of infrastructure disrupted by forces Majeure.

The report gives no details on how providing against such events might be achieved, although there are solutions that address potential electrical or network failures for Bitcoin (BTC) and other blockchain-based cryptocurrencies.

These include the development of mesh networks based around long-wave radio transmitters, and Blockstream’s satellite network, which broadcasts Bitcoin transactions via space.

#CBDC #BIS #BISDigitalCurrencyResearchGroup