Headlines

- Macro Strategist Raoul Pal Moves More Than 50% of Portfolio to Bitcoin in Big Bet on Future of Crypto

- MicroStrategy Board makes Bitcoin its primary reserve currency, may increase its holdings beyond $250M

- Bitcoin market cap will match JPMorgan’s if the $16.5K CME gap closes

- Mad Money host Jim Cramer forecasts a generational wealth storage shift

- BNP Paribas connects to major stock exchanges with DAML smart contracts

Disclaimer: NOT INVESTMENT ADVICE

Reading Notes

Macro Strategist Raoul Pal Moves More Than 50% of Portfolio to Bitcoin in Big Bet on Future of Crypto

We are all 100% aware of the downside risk in a 60 vol asset… this is not a trade for a great grandmother. I just want to be clear, with regards to being irresponsibly long bitcoin: I don’t use leverage. I fully expect to have to deal with a 50% drawdown and, I’m ok with it. I look at my allocation versus liquid assets and not my house etc. I am lucky to have an income stream, which is key. ~ Global Macro Investor founder and chief executive Raoul Pal, who is betting big on the future of digital currencies.

MicroStrategy Board makes Bitcoin its primary reserve currency, may increase its holdings beyond $250M

MicroStrategy has outperformed the Nasdaq since buying BTC. Now, it’s doubling down.

The move – Microstrategy’s Bitcoin investment – has already caused a slew of copycats, with smaller companies of every shape making similar announcements.

- It should be noted that MicroStrategy sold a domain to Block.one in 2019 for $30 million.

- Perhaps this gave the company’s leadership an appreciation of the value of cryptocurrency.

- Some of the world’s biggest institutional investors have a stake in the company.

- This may demonstrate how much more acceptable Bitcoin has become on Wall Street in the past few years.

Bitcoin market cap will match JPMorgan’s if the $16.5K CME gap closes

“As it turns out, bitcoin is better at being gold than gold — and not just incrementally, but by an order of magnitude or 10X better. It is a widely held belief in technology circles that when a product is 10X better than its closest substitute, it will escape its competition. We believe Bitcoin has achieved this.”

At $16,500, Bitcoin’s market cap would match that of JPMorgan, illustrating just how early the crypto sector is in its growth phase.

#Bitcoin‘s price if it reaches this market cap:

— MMCrypto (@MMcrypto) September 10, 2020

$16‘500 JP Morgan

$23‘000 Visa

$40‘300 Facebook

$106‘000 Apple

$487‘000 Gold

Lets go! 🚀

https://cointelegraph.com/news/bitcoin-market-cap-will-match-jpmorgans-if-the-165k-cme-gap-closes

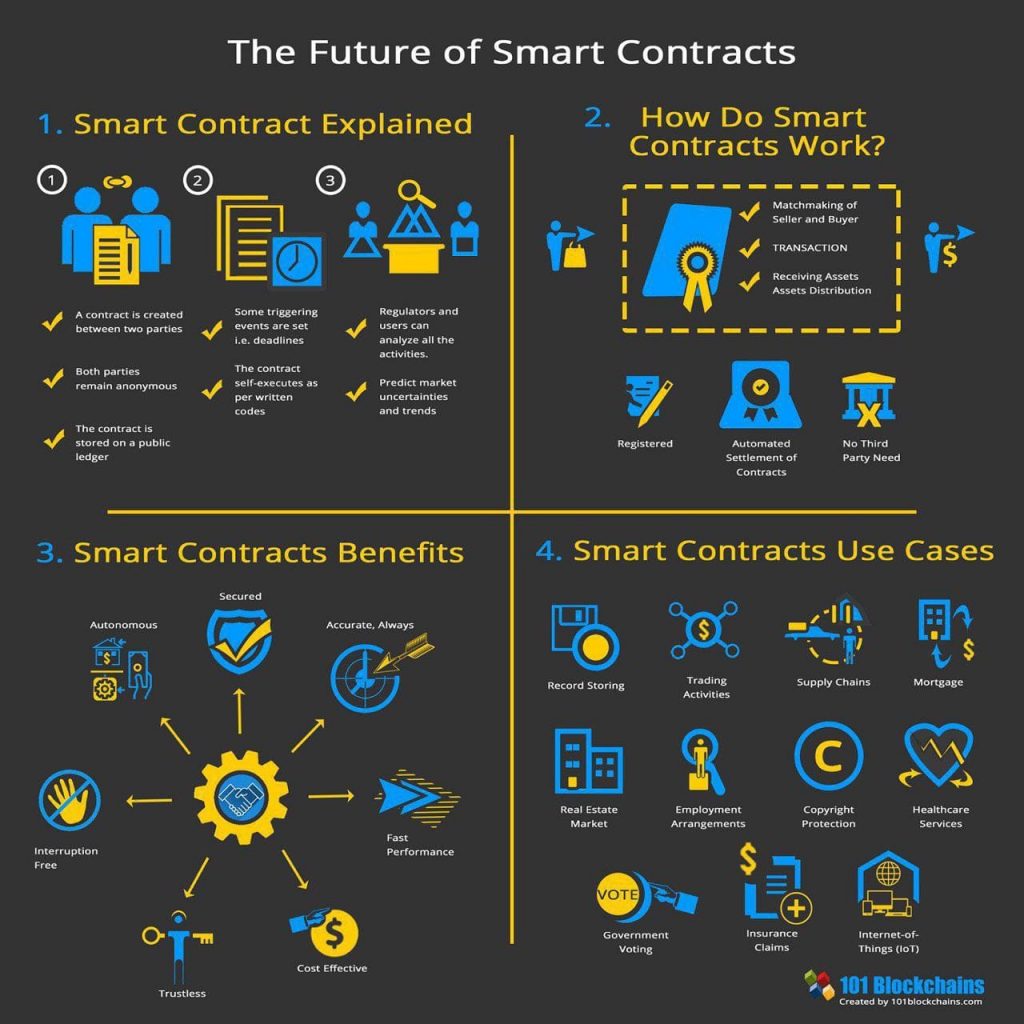

The Future of Smart Contract

BNP Paribas connects to major stock exchanges with DAML smart contracts

In 2019, the ASX and Digital Asset signed a Memorandum of Understanding stating that the stock exchange will support DAML as part of its CHESS blockchain registry. As reported, ASX’s CHESS system is coming in 2021.

Introduced in April 2016, DAML stands for Digital Asset Modeling Language and represents an expressive language designed for financial institutions to model and execute agreements through DLT and smart contracts.

The new DAML-driven apps will connect BNP Paribas Securities Services with major global stock exchanges like the Australian Securities Exchange, or ASX, and the Hong Kong Exchange, or HKEX.

The apps will provide market participants in the Asia Pacific with real-time access to ASX’s and HKEX’s upcoming blockchain-based trading and settlement platforms. BNP Paribas will specifically connect to the ASX’s blockchain-powered equity transaction platform known as the Clearing House Electronic Subregister System, or CHESS.

Mad Money host Jim Cramer forecasts a generational wealth storage shift

When I go to my inflation handbook, what it says is buy gold, buy masterpieces and buy mansions, what we didn’t have in that menu, was crypto. ~ Jim Cramer, host of the popular CNBC mainstream markets show, Mad Money.