Things are moving pretty fast in the blockchain and crypto space.

Looking at the headlines:

- World Bank Digs Deeper Into DLT and FinTech for Financial Inclusion

- The Suzhou trial – Digital Yuan Being Tested for a Workers’ Subsidies Scheme

- Aussie Crypto Unicorn Raises $160M With ‘Big Four’ Bank Backing

- The launch of 3iQ’s BTC Fund on TSX

- Berlin Real Estate Worth $12M Tokenized for Everyday Investors

- Akon City, a ‘sustainable eco-tourism smart city’ powered by Blockchain technology in Senegal.

Connecting the dots, the Blockchain’s shift from niche financial tool for techies to the mass adoption of digital currencies is happening into the conventional financial sphere. The interaction (blending or convergence?) of the two monetary worlds seems to be progressing positively.

The recent report by World Bank Group and Bank for International Settlements (BIS) further complement the previous report by BIS as CBDC (Central Bank-Issued Digital Currency) Is Well On Its Way.

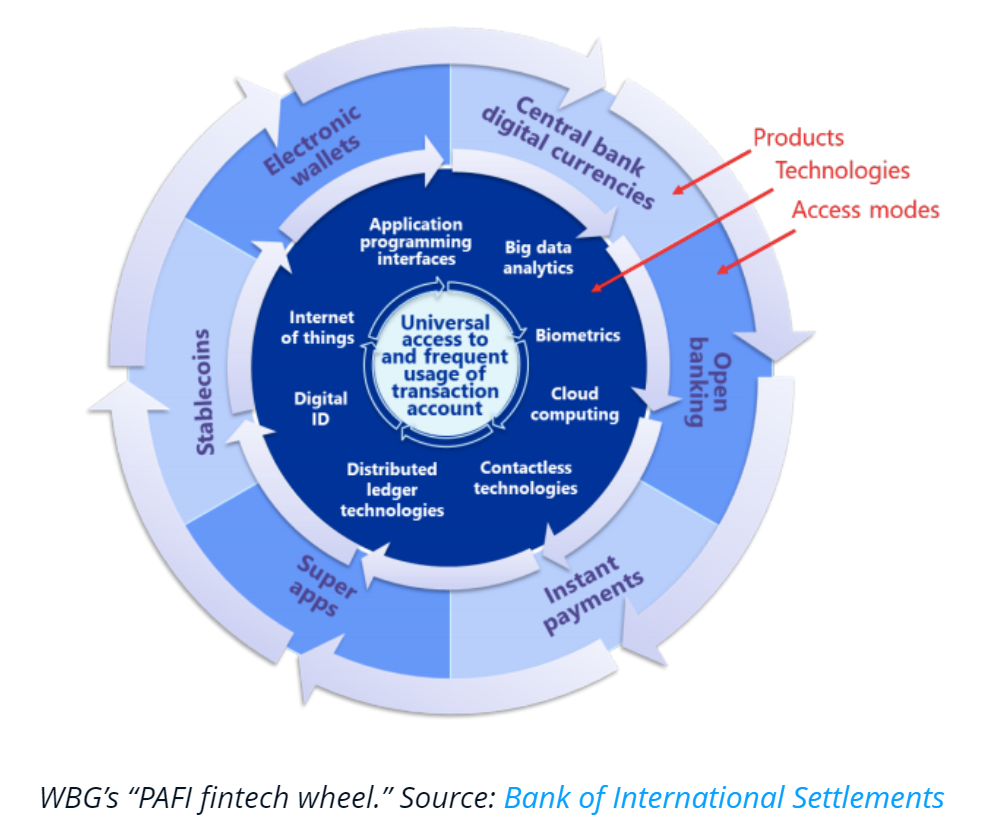

Payment Aspects of Financial Inclusion Fintech Wheel by World Bank Group

Worth noting is the PAFI Fintech Wheel in the report.

Jolted below notes related to above mentioned headlines, the power to relate is important in getting the bigger picture.

Click on the respective headline to read the original report.

World Bank Digs Deeper Into DLT and FinTech for Financial Inclusion

The World Bank’s fintech-focused report on financial inclusion is not the organization’s first foray into blockchain and associated emerging technologies.

Among major PAFI tools, the World Bank listed distributed ledger technology (DLT), stablecoins, CBDCs and payment tokenization systems, placing them in line with other fintechs like big data analytics and cloud computing.

Combining several technologies, products and access models, the World Bank drew up the so-called “PAFI fintech wheel” to identify fintech developments that are potentially relevant to the payment aspects of financial inclusion.

In the 70-page report, the bank provided a detailed overview of selected advances in technology that are considered to be the most relevant to payments as well as described their applications and associated risks.

The Suzhou trial – Digital Yuan Being Tested for a Workers’ Subsidies Scheme

This month, agencies and enterprises in the Xiangcheng District of Suzhou will reportedly be paying 50% of local workers’ transport subsidies in the new digital currency (also referred to as DC/EP, for “digital currency/electronic payment”).

These patents indicate that the DC/EP adopts a two-layer architecture and two-tier delivery system, which enables licensed third-party payment institutions or banks to participate in secondary issuance of the digital currency.

… the report notes that the currency’s blockchain structure will ensure “traceability, encryption and supervisability.”

Aussie Crypto Unicorn Raises $160M With ‘Big Four’ Bank Backing

In March 2019, Airwallex received a $1 billion valuation — ranking it as Australia’s second unicorn alongside graphic design firm, Canva. Australia is currently home to three unicorns, with aerial imagery company, Nearmap, recently joining the list.

The launch of 3iQ’s BTC Fund on TSX

The launch of 3iQ’s BTC Fund on TSX was a historic event, to say the least.

The listing of a publicly-traded Bitcoin fund on a major stock exchange will serve as an important milestone for the industry as a whole — especially in regard to crypto being viewed as a legitimate asset class by the global investment community.

Currently trading under the name, “The Bitcoin Fund,” the offering has around 1.5 million Class A “QBTC.U” shares available on the Toronto Stock Exchange, or TSX.

At press time, each share is trading for around $12. The price indexes being used by the fund are from crypto data company CryptoCompare and VanEck Europe subsidiary MV Index Solutions.

3iQ is serving as the fund’s investment and portfolio manager.

The Bitcoin Fund is under the custody of the Winklevoss’ exchange Gemini, and thus Tyler and his brother Cameron are invested in the fund’s success.

TSX is Canada’s premier stock exchange, facilitating more than $97 billion worth of monthly trade.

- customer demand for regulated crypto products has been strong across the investing spectrum — be it the retail or institutional investor market.

- as time goes on, market demand for crypto offerings will increase.

- the demand for an easily accessible, securities-based product delivered through traditional channels.

Berlin Real Estate Worth $12M Tokenized for Everyday Investors

Germany’s Black Manta Capital Partners has launched a security token offering (STO) for Berlin real estate worth more than $12 million.

The project is a collaboration with the German real estate firm Tigris Immobilien and includes around 2000 square metres of real estate in total, mostly comprising individual apartments from 40 to 60 square meters in size. Construction is expected to be complete by 2022 and units will be sold to investors and owner-occupiers.

Token holders will share 20% of the sale profits through securitized participation rights. The company said the tokens will enable ordinary investors “to participate in a profitable real estate project normally reserved for professional investors.”

Minimum investment is just €500 (Fractionization / Fractional Ownership)

Blockchain technology is gaining steam in the real estate market with real estate security tokens now representing half of active security token markets and 15% of total volume.

- new “tokenization services” industry to emerge and the crypto custodian market to grow.

- institutional investors require regulated custodians

Akon City, a ‘sustainable eco-tourism smart city’ powered by Blockchain technology in Senegal

Blockchain’s shift from niche financial tool for techies to the mass adoption of digital currencies.

The celebrity singer famous for his “Lonely” song, is not only embark on lighting a million homes project, but also developing Akon City, a ‘sustainable eco-tourism smart city’ in Senegal.

While those listed above are quite a number of positive progress, some news shouldn’t be overlooked, especially when it concerns custodian services and legistration.

Where on the planet is KuCoin?

Unlike Binance, Coinbase and Ripple, KuCoin did not file with the Monetary Authority of Singapore to request a deferral of the requirement to operate without a payments license. Such deferrals allow those companies to operate as payments service providers without a license through July.

Without a license or a deferral, KuCoin cannot legally operate in Singapore. It remains unclear whether KuCoin is nonetheless operating in Singapore or if the exchange is in fact now operating elsewhere.