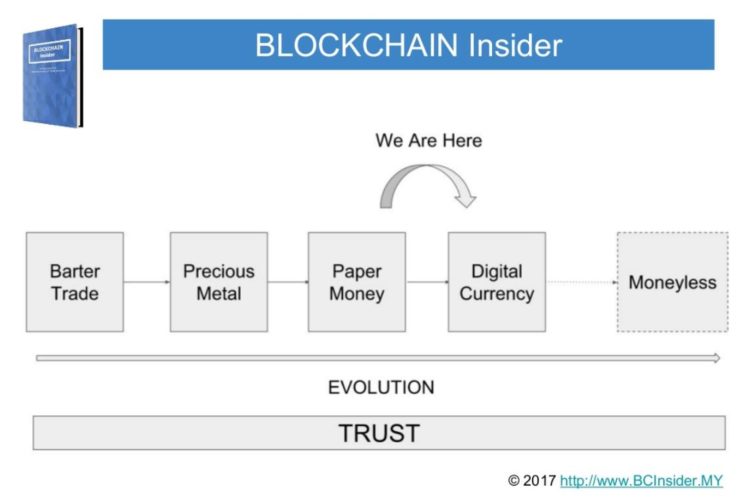

The evolution of money centered around a very important element, trust.

As a human, we find ways to lower uncertainty about one another so that we can exchange values. It is safe to say that the monetary system we are using today (as at the time of writing), is the largest ever trust-based system that we, human being, ever created.

The Evolution of Money, A Trust-based System

Over the course of human history, people find ways to exchange values. Before the concept of money was introduced, we traded among each other, within our own community. Barter trade was good enough for hunter-gatherer age of time. The reciprocal exchange is immediate, not delayed in time.

As societies and trade distant grew, so were the complexity and uncertainties. Our control over trades declined, time and resources are limited, we need the help of intermediaries. Middlemen came into the picture to facilitate our tradings. Instead of direct dealings, we go through different mediums or platforms, just to deliver a product or services across a distance to another party.

A medium of exchange was needed, and the concept of money just came handy. In the early days, there were precious metals like gold, silver, copper etc. to fuel the trades. As civilization evolved, paper money was introduced due to its convenience and better efficiency when compared to precious metals.

Financially, the system evolved as well, and paper money that was once pegged to gold was taken off the standard. Instead of backed by commodity or gold, we are living in a debt based system now.

There is another name for the medium of exchange under such as system, which is fiat money, currency that a government has declared to be legal tender, yet it is not backed by a physical commodity. The value of fiat money is derived from the relationship between supply and demand rather than the value of the material that the money is made of. In other words, trust plays a very important role than ever in the value of a certain currency.

Generally speaking, the paper money is now IOUs, which means that all monies circulating in our monetary system are the debts owed to somebody else.

There are problems. Inflation and deflation. Greed and manipulation.

We need an alternative solution. At the brink of global financial crisis, sometime in 2008-2009, Bitcoin’s white paper was introduced to the world. As they said, the rest is history.

We are now in the transition period of moving from paper money to digital currency.

With technology in place, such as Blockchain, Big Data, Business Intelligence, Artificial Intelligence, IoTs (Internet of Things), we could predict a future where money is not needed anymore as a tool to lower uncertainty in order to facilitate trades or to distribute resources.

A new kind of trust will be implemented, as we are moving towards a moneyless society. Our upcoming generations shall see a moneyless future.

|

Captain Jean-Luc Picard: The economics of the future are somewhat different. You see, money doesn’t exist in the 24th century.

Lily Sloane: No money? You mean, you don’t get paid? Captain Jean-Luc Picard: The acquisition of wealth is no longer the driving force of our lives. We work to better ourselves and the rest of humanity. Actually, we’re all like yourself and Dr. Cochrane. ~ Star Trek: First Contact (1996) |

While the future remains unknown, it is quite promising.

The article above was extracted from Chapter 1 of the book Blockchain Insider, which is to be published soon.