A Matter Of Trust, Circulation, And Compliance.

What’s the biggest challenge of all facing the real estate industry now?

Liquidity.

What can be done in a credit crunch situation?

Alternative funding, or a new source of money, given the opportunities brought by the blockchain technology.

With new technologies come new opportunities.

While blockchain promises transparency, traceability, and immutability, we can look at it from either the technology part or economic side of it, or both.

This is the dawn of a new era. Technology is bringing down borders of the legacy system. Blockchain will disrupt the bankings’ financing business just like how the web disrupted the telcos’ communication business.

The billion dollar question is:

How Can The Real Estate Industry Embrace Blockchain Technology And The Crypto Economy?

Tokenization is one of the ways.

But it has to be done step by step, one at a time. This is because the real estate industry is a highly regulated market, just after banking and finance.

The ABCD+X Business Track

Awareness

Industry-specific stakeholders must be well aware of what is going to happen from a broader view. Initially, test water approaches can be carried out, to know the acceptance level and the readiness at the new frontier.

Business Model

Once the situation or condition is getting clearer, high level perspective of how things should work must be figured out. This concerns mainly the people and the process.

Conceptional Design

Drill down to resource identification, system architecture, detailed flow charts etc. related to facilitation of system development. Documents such as Blueprint, Functional Design Specification, Project Management Plan, Data Modelling Design etc. should be ready.

Development And Deployment

Hands on and project implementation. Beta to stable version and upgrading lifecycle.

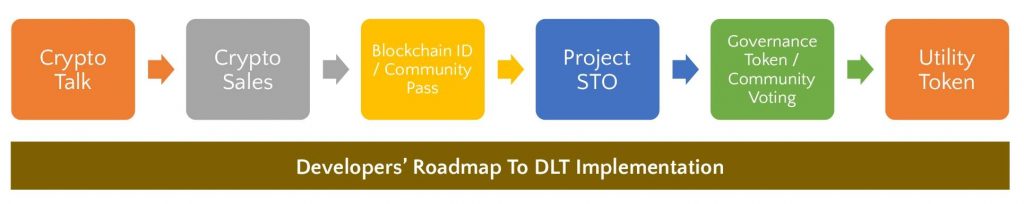

Case Study: Property Developers’ Roadmap To DLT Implementation

Image below shows the proposed approach to a real estate developer looking at possibilities of integrating crypto payment and blockchain technology in their residential and commercial development projects.

Note that it doesn’t have to be in exact sequence. These are the components in one possible pathway to tokenization.

Start something somewhere, somehow.

The courage and ability to take actions while others are still hesitating is what separates market leaders from the rest. It doesn’t have to be a drastic move.

For instance, creating awareness and getting market feedback or responses through series of talk or seminar or workshop will increase the possibilities of pulling in the right crowd. In this case, the cryptocurrency players or holders, who may have in their hand a handsome amount of tradeable cryptocurrency.

Moving forward, start to familiarize the corporate itself by accepting cryptocurrency as a method of payment. Exchange products or services with crypto.

This is not theoretical anymore. Malaysian company such as KLSE listed property counter CHHB is pioneering the crypto adoption. On the global shores, Nasdaq listed, the world’s largest business intelligence software company Microstrategy adopted Bitcoin as a primary treasury reserve asset in the multi-million dollar scale.

From the initial stage of familiarizing with crypto economy, the real estate developer can then further explore fractional ownership options, Securities Token Offering (STO) for project funding, functional token for community management and other great opportunities to be unleashed.

People, process, technology. People come first. Technology is just the enabler.