Why should I give a damn about bitcoin? The day you started earning and spending money is the day you began repeatedly handling over slices of that money to these middlemen, often adding up to millions of dollars over a single person’s lifetime. Crytocurrency promises to stop that outflow and put the money back in your pocket.

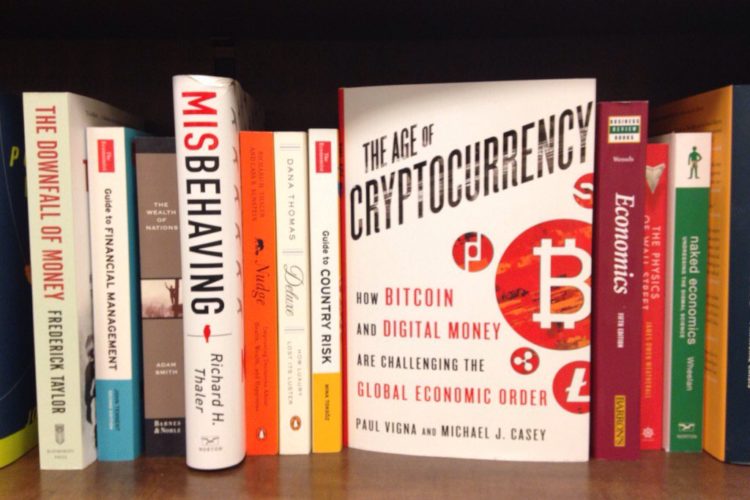

Read MoreThe Age of Cryptocurrency