CBDC (Central Bank-Issued Digital Currency) Is Well On Its Way

Central banks are progressively studying the introduction of CBDCs and their potential impact on the banking system.

The Bank of England Staff Working Paper No. 725 titled Central bank digital currencies — design principles and balance sheet implications by Michael Kumhof and Clare Noone dated 18th May 2018, laid out various scenarios of possible risks and financial stability issues of central bank digital currencies (CBDCs).

The Working Paper, No 1 | 2018 of Norway’s central bank, Norges Bank, stated that it is considering developing its own digital currency as a supplement to cash to “ensure confidence in money and the monetary system”.

Reuters reported on 17th May 2018 that Switzerland is seeking the study of state-backed “e-franc” cryptocurrency.

A Statement on Developmental and Regulatory Policies released on Thursday, 5th April 2018 shows that The Reserve Bank of India (RBI) is looking into issuing its own central bank digital currency (CBDC), after a meeting of the Monetary Policy Committee (MPC).

These come with no surprise because as early as 2016, the Bank of England and the People’s Bank of China had explored the idea of issuing their own digital currencies, with over 90 central banks worldwide that same year investigating DLT – Distributed Ledger Technology.

More good outlook as Anthony Lewis, research director at global banking consortium and enterprise software firm R3, predicted that a central bank issued digital currency (CBDC) will be implemented in 2018 in a panel discussion at Deconomy in South Korea on 4th April 2018.

CBDC at a glance

Russia – CryptoRuble

Japan – J-Coin

Venezuela – Petro, an oil-backed cryptocurrency

Singapore – project UBIN

Bank of Canada – Project Jasper

United States – toying with the idea of a FedCoin

Sweden’s Riksbank – contemplating the e-Krona

and the list is growing for sure.

CBDC related bank / central bank’s papers

Central bank digital currencies — design principles and balance sheet implications, Bank of England

18th May 2018

Central bank digital currencies, Norges Bank

NORGES BANK PAPERS NO 1 | 2018

Central Bank Digital Currencies, Bank for International Settlements

CPMI Papers | No 174 | 12 March 2018

Statement on Developmental and Regulatory Policies, Reserve Bank of India

April 05, 2018

CBDC (Central Bank-Issued Digital Currency) Explained

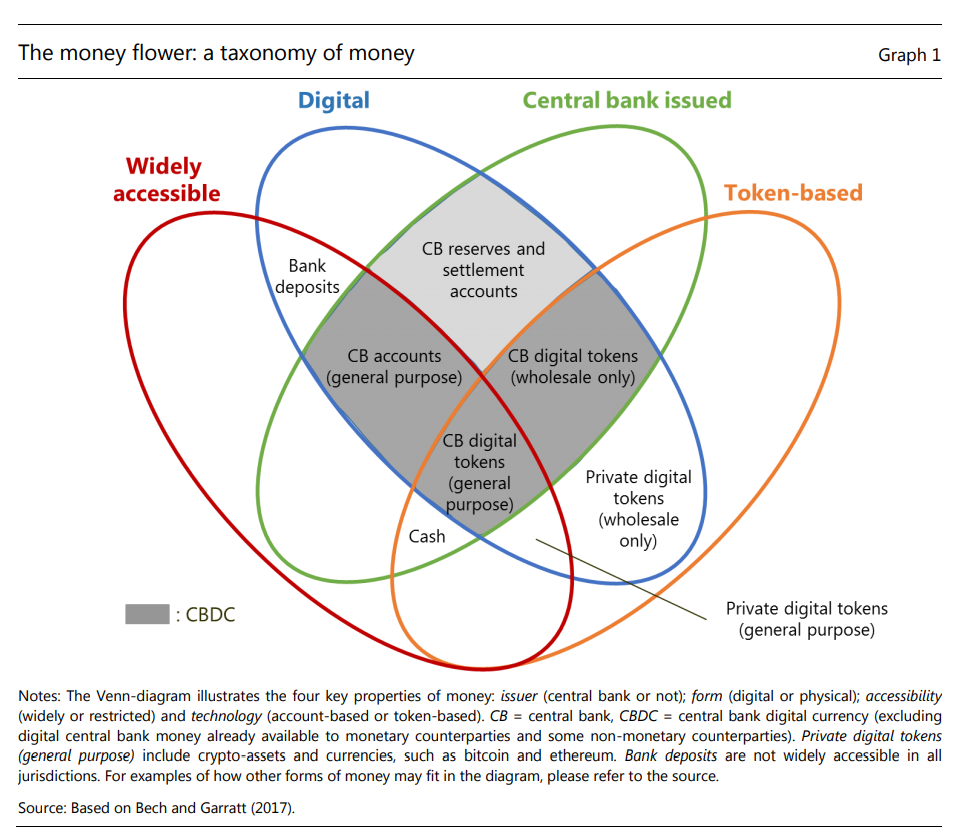

As defined by R3, an enterprise software firm working with a network of over 200 banks, financial institutions, regulators, trade associations, professional services firms and technology companies to develop on Corda, a blockchain platform designed specifically for businesses, a CBDC is a digital store of value (money) and method of exchange issued by a central bank. Theoretically, it introduces a new digital mechanism for real-time settlement between individuals.

So what’s the difference between cryptocurrency and CBDC?

Cryptocurrency is a blockchain asset and not the liability of anyone. Central bank issued digital currency is based on a fractional reserve banking system based on debt and the liability of increasingly highly indebted nation state central banks. ~ Rainer Michael Preiss, Coin Telegraph

The Money Flower image below illustrates the relationship well.

The Money Flower

Some people like flowers, and most people like money. How about a money flower?

Image Source: The BIS (Bank for International Settlements) report

More about Blockchain and Cryptocurrency in my speech transcript for MBLBC Oval Debate, Kuala Lumpur: